What If You Don't Use Accident Money

If a stranger sends you money past accident, do you have any obligation to give information technology back? If so, how exercise you do information technology without exposing yourself to a scam? And if y'all transfer money to the wrong person, is there any possible mode to fix your error?

These are not uncommon dilemmas faced by users of greenbacks apps similar Zelle and Venmo in 2021. Along with the increasing popularity and convenience of instant money transfer services came a dramatic rising in pricey user errors. Unfortunately, our attempts to investigate and resolve many of these cases accept exposed some agonizing flaws in the programs.

Minh Tran is simply one of the many desperate Zelle users who've recently asked our team for help. In his example, a stranger'southward mistake set off a frustrating and disruptive chain of events that almost cost him $360.

Here's his story.

Surprise! A stranger simply sent y'all money!

One morning last February, Tran was surprised by an alert from Zelle on his phone. A stranger named Anthony had but sent him some money.

I was confused. I didn't know this guy, but there was no manner to stop the transfer, or I would take blocked it. In minutes, he [Anthony] called me in a panic and asked if I would please reverse the charge. He told me the money was for his rent, and he needed it back correct away.

No trouble, Tran idea. Of course, he would give the anonymous person his money dorsum. But he wanted to check with his bank first.

"It wasn't mine," Tran explained. "I had no intention of keeping the guy's rent money!"

Elliott Advocacy is underwritten by Flight Angels. Flight Angels provide medical transport anywhere in the earth on commercial airlines with a Flight Nurse or Doctor. A Flight Coordinator handles the logistics. The client receives care during the unabridged transport—bedside to bedside. Visit FlyingAngels.com or phone call 877-265-1085 to speak with a flight coordinator.

Later on first confirming with a Chase representative that it was prophylactic to send the coin dorsum, Tran entered Anthony'due south phone number into the Zelle app. He instantly sent the $360 back to where it came. Soon the relieved stranger confirmed the transaction and thanked Tran for his help correcting the trouble.

Tran didn't requite the odd interaction some other thought until a few days subsequently.

A new alarm cast a more sinister shadow on Anthony'due south "fault."

Zelle transactions are not reversible. And then what happened here?

At the same time, Anthony was asking Tran to transport the money back, he was also pleading with Zelle. His request to opposite the transaction seems to accept fallen on a sympathetic ear at the company. And fifty-fifty though Zelle states all transactions are final, that agent initiated a reversal of his mistake.

"Zelle sent me another notification that information technology reversed Anthony's showtime transfer to me," Tran reported. "Merely it also processed my payment to him as well."

At present it appeared that the stranger who had accidentally sent Tran his rent coin had successfully reversed that Zelle transaction. Simply he had also convinced Tran to send him $360.

Tran realized that his efforts to right the stranger'south mistake had put his own money in jeopardy.

Still unsure whether he was involved in a scam or just some baroque glitch with Zelle, Tran picked upwardly the telephone. He first called Zelle and explained the unusual events.

He asked the Zelle representative to correct the problem by reversing his payment to Anthony. That would leave both Zelle users even.

Unfortunately, Tran'south logical request did not land on the same sympathetic ear as Anthony'due south did. That representative stuck with protocol and explained that transaction reversals are not possible on the platform.

"All Zelle transfers are terminal and irrevocable," the agent explained. "You tin can ask the recipient of your transfer to send the money back to you."

Tran explained to the agent that Zelle had reversed a transaction in his account. So he knew it was possible. But the employee remained unmoved and reiterated that Tran could telephone call Anthony and ask him to set up the problem. The other pick, she said, was to speak to Chase.

That'south where things became even more complicated.

Zelle didn't opposite this transaction

Tran chosen Anthony and explained what had happened. He hoped they could rapidly settle this fiasco. If Anthony would but ship dorsum the $360, and then they would be even.

Merely Anthony had surprising news that threw a wrench in this plan.

[Anthony] said Zelle didn't give him the money back. He said his account just showed ii transactions. The money he sent me and then me returning his money to him. Co-ordinate to his records, we were even. Merely he said if Zelle eventually sent him another $360, he would give it dorsum to me.

Over the adjacent several days, Tran checked back with Anthony frequently to run across if Zelle completed the reversal. Only when the coin never materialized in either man's business relationship, Tran decided to involve Chase.

Surely his bank would be able to right this wrong, he idea — especially since the Chase representative had confirmed it was safety for him to ship the funds back in the get-go place.

It turns out that was a lofty expectation.

Hunt: You lot've received a payment in error

When Tran contacted Chase, he explained that he wasn't quite certain what happened. He had several conversations with the stranger, and it wasn't his impression that the guy was a scammer. Only the truth was he didn't know the person at all.

A representative at Chase took down all the details of the debacle and assured him that its squad would investigate.

Hopeful that the unpleasant feel was about to exist over, Tran breathed a sigh of relief.

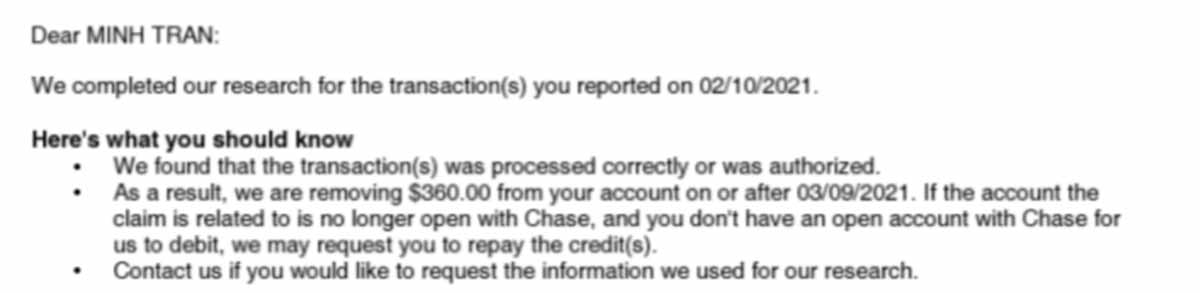

Unfortunately, that relief was short-lived. Within a few weeks, Chase provided the results of its investigation.

"The Hunt representative told me it determined I had received a payment in error through Zelle," Tran recalled. "Simply that wasn't the transaction I was disputing!"

Tran pointed out that he was disputing his payment to the stranger. That was the transaction that he had merely sent in an effort to return Anthony'due south money to its rightful owner. Chase then agreed to investigate that transaction too. Their team bodacious Tran they would conclude the investigation within thirty days.

This time, Chase credited Tran's account while it looked into the problem.

Tran wondered if the fiasco would ever exist over.

Cash app users beware: If you qualify a money transfer, the banking company will not reverse information technology.

Over again, Tran didn't have to wait long for the response from Hunt.

Tran couldn't believe what he was reading. It appeared to him that no one at Hunt understood the sequence of events. He never denied making the Zelle payment to Anthony. But he only fabricated the transfer because he had received money from a stranger and wanted to give information technology dorsum.

At present Tran had no idea what to exercise. He started scrolling through the net, looking for answers. That's when he came across a story I had recently written from the other side of this type of cash app mistake.

- What can you do if you sent money to a stranger?"

Equally he read through the Zelle fiasco of Rossin Asilo, Tran became hopeful that we could help him, too.

Help! A stranger sent me coin. How did I end up losing?

When I reviewed Tran's newspaper trail, it took me by surprise. The previous week I had spoken at length to our executive contact at Zelle well-nigh the app. She had bodacious me that a chargeback scam — the kind that it appeared Tran was caught in — was not possible.

"It'south not possible to dispute Zelle transactions," she explained.

But at that place in Tran's Chase records was a transaction that said "Zelle Dispute."

"I had fifty-fifty asked Chase if it was safe for me to send the money back to Anthony," Tran lamented. "The amanuensis told me it was fine, so I did information technology. At present I concluded up losing $360!"

It was time to inquire Zelle why someone had reversed this transaction despite reversals being against policy.

Request Zelle: Is this a chargeback scam or something else?

Hi *****!

Nosotros've got a bit of an unusual situation hither. After we spoke terminal week, I updated my article to explain to our readers why the Venmo chargeback scam is not possible using Zelle since chargebacks aren't allowed on your platform. But then I heard from Minh Tran, who appears to have simply been victimized past the Venmo chargeback scam — but on Zelle.

On Feb three, a stranger sent him a $360 Zelle payment by accident so immediately asked him to please transport information technology back. Tran sent it back the next mean solar day with a new Zelle transaction (and after speaking to Chase). But a few days later, Zelle took another $360 out of his account and labeled it as a Zelle Dispute. Hunt said he was the unintended recipient of the original $360, and that's why the payment was reversed. Only he had already sent the coin back. And so now he's out $360. Chase closed the case and allowed the Zelle dispute to stand.

Could you have your squad look at this example and see if we can help straighten this out for Mr. Tran? Thank you lot!😊 Michelle

I forwarded all of Tran's interactions with Anthony as well. And soon, Tran's two-month saga came to a positive determination.

Zelle: Once you initiate a transaction, nosotros won't reverse it, but…

Our executive contact at Zelle reiterated that app users must be very careful considering all transactions are final. She explained that only in cases of fraud can a dispute be open on their side.

Only no fraud had occurred in Tran's case — so what went wrong, I asked.

Information technology seems that in Anthony'due south panicked land, he may have misrepresented the nature of his mistake as fraud. Or the Zelle agent misunderstood the policies. It might have been both, but the issue was that a dispute was partially initiated. Zelle removed the money from Tran's account but didn't return it to Anthony.

The bottom line: The Zelle user agreement says that all transactions are concluding. So when Tran asked Chase to reverse his payment, he didn't have a risk of winning that dispute — at least not without the intervention of a savvy consumer advancement team.

In the end, the teams at Zelle and Chase made certain that Tran received his $360. After months of unnecessary aggravation, he has been fabricated whole.

Cash app users: Pay attention!

Since we first published the tale of Rossin Asilo last calendar month — the Zelle user who sent a memorial gift to a business concern owner by error — we've been receiving a steady stream of pleas for help from cash app users.

Different Tran's experience, most of these cases involve users who mistakenly sent coin to a stranger. Some of these troubled users accept sent thousands of dollars to unknown recipients in mistake.

But all the cases have an essential commonality — the user neglected to read the prompts on the screen during the transaction. It'south virtually impossible to ship money to the wrong person if you read the information on the screen carefully before clicking ship. In fact, you must confirm the destination twice earlier Zelle sends the coin on its way.

The bottom line: Y'all tin can't get your money back after you send information technology through Zelle

- Information technology is not possible to reverse your Zelle error

The lesser line is that at that place is no mechanism in place at Zelle that allows users to retrieve a transaction. In one case you ship the cash, information technology's gone. These are depository financial institution-to-banking concern transfers, and the money instantly is deposited in the recipient's bank account. And because of privacy laws, the banks are not compelled to tell you who received the money if you send it to the incorrect person. And so use Zelle with caution. - But use cash apps to transport money to people y'all know

Exercise not send money to strangers on purpose. A new scam that yous tin read near here, involves scammers on Zelle who offering to sell you cute — and expensive — puppies or kittens. (Hint: Yous'll never go a puppy or kitten out of the bargain — you'll only lose your money.) You should not buy or sell anything using a cash app. Remember, if you pay for anything using Zelle, the Fair Credit Billing Human activity does not protect your buy. - You may need to become an attorney

If yous've sent a lot of money to the wrong person who will not give it back, you may need to consult an attorney. In all the Zelle cases I've investigated, the banks have made an effort to mediate the return of the misdirected funds. But as in Rossin Asilo's case, the recipient may decline and make up one's mind to keep the money even with the bank's involvement. Because of privacy laws, the receiver of misrouted funds tin simply ignore the bank's enquiry.

Tips: If a stranger sends you lot money via a coin transfer app, what can y'all exercise?

But what about the innocent "victims" of these money transfer errors? Most honest people don't want to financially benefit from the mistake of a stranger. But as, no one wants to get scammed. So what's the answer?

I've asked representatives from both Chase and Zelle, and unfortunately, it doesn't seem that there is a articulate-cut answer. Yet, here are a few tips that tin can help you avoid a cash app fiasco of your ain if a stranger sends yous greenbacks past accident.

- Empathize the cash app

In today's world, there are a plethora of instant money transfer services. Each ane of those platforms comes with its ain unique terms and weather. Information technology'due south critical that before you connect whatsoever cash app to your bank business relationship or credit carte, you read through the entire user agreement. Unless you familiarize yourself with that certificate, at that place's no mode to understand the risks involved. An informed consumer is a smart consumer — so read the terms and weather. - E'er involve your bank

Should you lot observe a lump of cash in your bank account dropped there by a stranger, ask your bank for help. (FYI: To make this process easier, our company contacts database contains executive email information for virtually banks.) Money transfer apps announced to have replaced wire transfers as the preferred payment method of scammers. To protect yourself from current and emerging scams, ask your banking company for guidance if someone you're unfamiliar with sends you lot money and asks for you lot to send it correct dorsum. BUT… - Keep a paper trail

Your depository financial institution may reject to investigate or facilitate the removal of the unwanted funds. Time and again, we've seen both Zelle representatives and bank agents encourage users to piece of work it out among themselves. In fact, the current guidance that Zelle repeatedly offers to its users who send or receive greenbacks in error is to contact the user on the other end. In an upcoming story, readers will find out why this could actually be dangerous. If you've sent or received money from a stranger who responds to you with threats of physical violence, please don't make further contact. You volition likely need the assistance of an attorney or even law enforcement. (Run across: This is how a greenbacks app mistake tin can turn deadly!) - Turn off the greenbacks app

Many Zelle users are surprised to learn that at that place is currently no mechanism that allows the receiver to decline a transfer. This seems like a gaping hole in the service that exposes users to potential scams and unwanted problems. A user should have the ability to accept or decline a deposit. At this time, the only style to be assured that y'all won't receive a cash drop from a stranger is by turning the service completely off. - Contact your state'due south chaser general

The more than complaints an chaser full general receives most a particular problem, the more likely the AG'south function volition investigate and take activeness. If you've received money from someone you lot don't know (or sent money to a stranger) and your bank won't help you correct the mistake, file a complaint with your attorney full general in your state. Here'south how to detect your attorney general. Michelle Couch-Friedman, Elliott Advancement

Source: https://www.elliott.org/problem-solved/received-money-from-stranger-money-transfer-app/

Posted by: rileypulded.blogspot.com

0 Response to "What If You Don't Use Accident Money"

Post a Comment